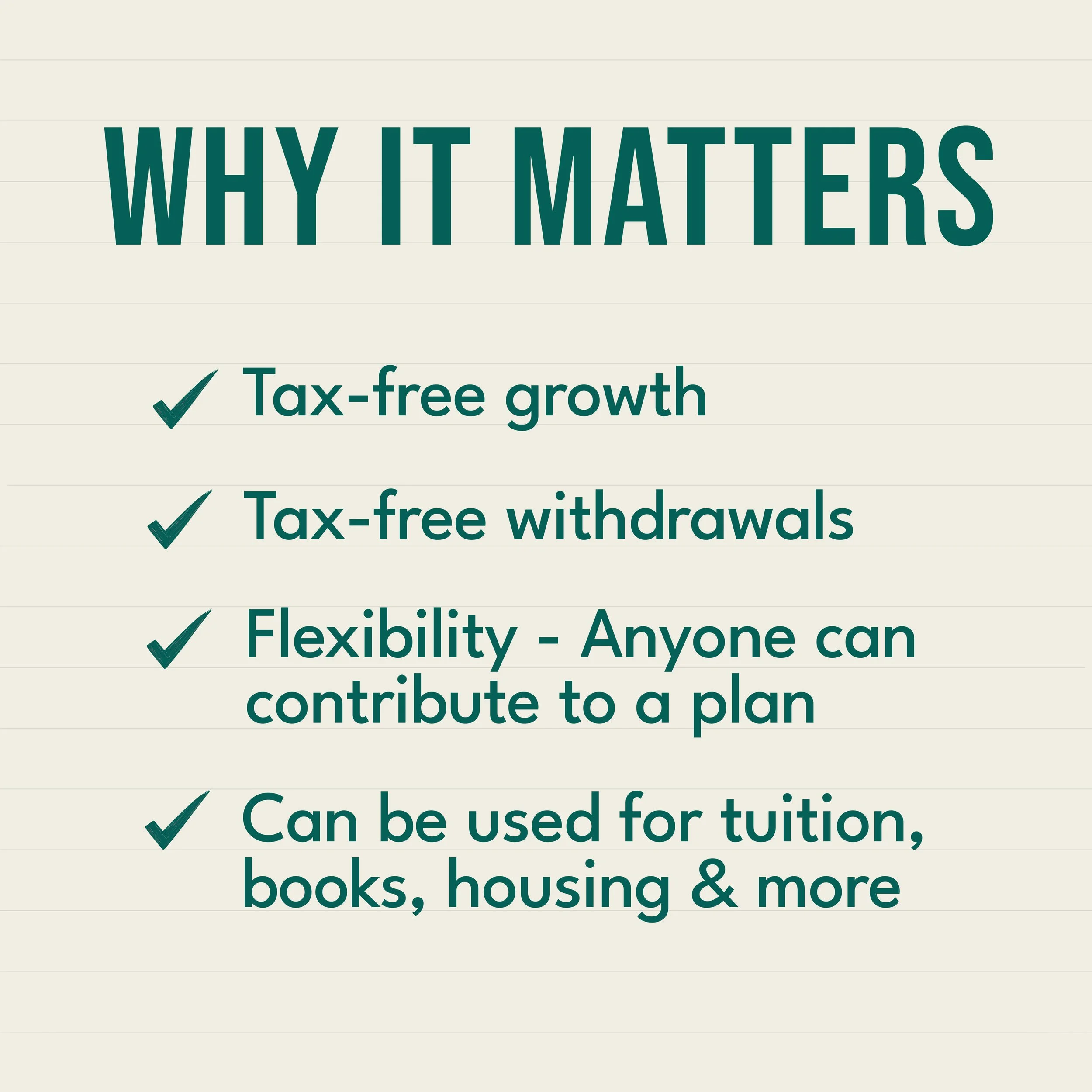

This week on The Lebenthal Report we welcome back returning guest Kristia Adrian. Kristia "Kris" Adrian, Executive Director, serves as the 529 Specialist for J.P. Morgan Asset Management. In her role, Kris travels throughout the country to educate clients and advisors on college planning and the Advisor-Guided 529 Plan using College Planning Essentials.

Previously, Kris was an Internal Client Advisor for over a decade with J.P. Morgan Asset Management building advisory relationships with independent broker-dealers. She started her career in 2001 as an independent advisor with Royal Alliance Associates, focused on high-net-worth clients and estate planning. Kris holds a B.S. in Family Financial Planning from The Ohio State University. She is Series 7 and 63 licensed and resides in Columbus, OH.

On the podcast, Kris helps navigate a simplified explanation of 529 with Michael and Dominick. Tune into this episode on Voiceamerica.com, YouTube, Apple Podcasts or Spotify.